Bitcoin Halving 2024: All you need to know

Given Bitcoin’s status as one of the most important and leading Cryptocurrencies, traders and market watchers may want to keep track of any events that could shift Bitcoin's price and cause potential volatility in the markets in general, and the Cryptocurrency market, in particular. One of the most anticipated and influential events that should probably be kept in mind is the Bitcoin Halving.

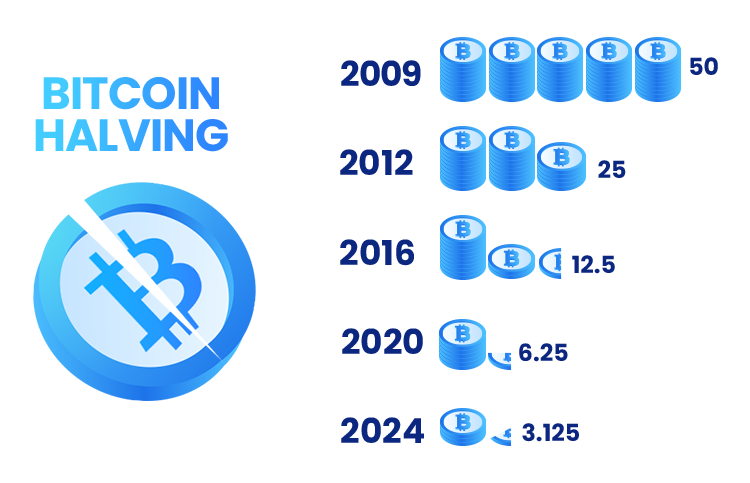

Since its creation in 2009 Bitcoin underwent 3 halvings (or Halvenings) and the price of Bitcoin was impacted. The next Bitcoin Halving is expected to take place in April 2024, and since we are currently living in a very different economic landscape than that of the last Halving events: what might this mean for Bitcoin’s price after the next Halving? Here’s what you need to know about 2024’s Bitcoin Halving, what a Bitcoin Halving is, Bitcoin Halving history and dates, and how Bitcoin Halvings work in general.

TL;DR

Understanding the Bitcoin Network: Bitcoin Mining Explained

To understand the definition of Bitcoin Halving, it is important to know how the Bitcoin network operates. Bitcoin operates through a decentralized system known as blockchain, which validates and records transactions. This enables individuals to exchange a digital currency (Bitcoins) directly, eliminating the requirement for a central entity.

In addition, Bitcoins are mined, which means that people (miners) use computers to solve difficult math problems in order to validate Bitcoin transactions and increase network security. When a problem is solved, the miners who solved it earn new Bitcoins as a prize, and new Bitcoins are generated. As such, when halving events happen, Bitcoin mining is directly affected. To understand how Bitcoin functions better, read our article on "How Bitcoin Works".

What Is Bitcoin Halving and How Does It Work?

In simple terms, Bitcoin (BTC) Halving refers to the event that happens every 4 years whereby mining new coins is affected and new Bitcoin production is cut in half.

In other words, when a Halving event occurs, miners receive 50% fewer Bitcoin, for the same amount of effort. The purpose of a Halving event is supply and demand: With less supply, there is greater demand, and thus the value of each Bitcoin is generally expected to increase.

Why Does Bitcoin Halving Occur?

A Bitcoin Halving event can take place in order to mainly ensure the following factors:

- Inflation Control: Bitcoin is halved to curb the potential inflation within the Bitcoin system. This is because when the production of new Bitcoins is reduced and block rewards are decreased, Bitcoin’s long-term price stability and value are more likely to be retained which helps control price inflation.

- Scarcity and Controlled Supply: Bitcoin was created with the intent of being a rare and limited Cryptocurrency. As such, when Bitcoins are halved, their availability becomes rarer, which can then affect their value and supply.

How Does Bitcoin Halving Affect Bitcoin Trading?

At face value, a Halving might sound like a negative event for Bitcoin miners; however, for traders and investors, it can come with many positives depending on their goals and positions. While past results cannot indicate future performance, interestingly, in the past halvings Bitcoin’s price surged and strengthened against the US dollar. Accordingly, for some Bitcoin investors and traders, the halvings’ effects may have come as welcome news then.

Here are more factors Bitcoin Halvings can influence:

- Bitcoin Prices: Halving directly affects Bitcoin prices both in the short and long run. Past Halvings have resulted in an increase in Bitcoin price volatility, hence causing Bitcoin prices to shift. In addition, many market participants refer to Halvings as a potential gauge for Bitcoin prices in the future, hence affecting the price outlook.

- Market Sentiment: Due to the fact that Bitcoin Halvings can pique many market participants' interest, it can also affect market sentiment (how the market approaches Bitcoin), which in turn affects trading activity.

Bitcoin Halving Dates: When Did the Previous Bitcoin Halvings Happen?

As mentioned above, since 2009, there have been 3 separate Bitcoin Halving events. The first time a Bitcoin Halving occurred was on November 28th, 2012. By that year, about 10,500,000 Bitcoin had been mined, and each valued at approximately $11 a coin. Within the next year, this value would rise a hundredfold. The next Bitcoin Halving took place on July 9th, 2016, whereas the most recent Halving occurred on May 11, 2020. As for when the next Bitcoin Halving event might take place, many posit that it is expected to occur, in April 2024. Here’s an infographic of what happened the last time Bitcoin was halved:

Does the Bitcoin Halving Have an Impact on the Price of BTC?

In the aftermath of past Halvings, the price of Bitcoin against the US dollar has appreciated. For instance, after the Halving event of 2012, the price of BTC/USD skyrocketed from around $11 to over $1000 in a single year - an increase of 80 times. After the Halving of 2016, the price of Bitcoin increased again; BTC remained in the $580-700 price range for a couple of months before slowly gaining towards the end of the year to the $900 level.

It may be interesting to note that following the halving of May 11, 2020, Bitcoin’s price did not rise immediately as factors like the Coronavirus actually caused it to depreciate. Nonetheless, in July 2020, Bitcoin rose to over $12,000.

However, it is important to note that the demand for Bitcoin can drastically fluctuate and that the circumstances around each Halving are very different. This means that it is not at all easy to attribute a bullish or bearish price movement to a specific Halving event.

How Often Does the Bitcoin Split Occur?

Bitcoin Halvings are scheduled to happen every time 210,000 blocks are mined, which occurs approximately once every four years.

The Pros and Cons of the Bitcoin Halving

As the price of Bitcoin tends to increase after each Halving, Bitcoin owners generally feel the positive effects; the value of their holdings generally increases.

Halving events tend to be a good thing for the demand for Bitcoin, as supply drops - this can be considered a catalyst for positive price action for the future of Bitcoin and the other altcoins.

However, traders must keep in mind that there may be some negative after-effects of the Bitcoin Halving. Some analysts have predicted that other altcoins may suffer as a result of the Halving; after Bitcoin’s bull run in 2019 a lot of the smaller altcoins suffered when their investors turned to Bitcoin.

There is also the risk that Bitcoin could suffer a big crash if the miners sell off their rewards because of the sudden doubled cost they’ll incur to mine.

Volatility also tends to occur as a result of a Halving, which can be a pro or a con - generally volatility increases before and after the event. Traders can use volatility to their advantage of course; however, wild price fluctuations also can make it difficult to ascertain a pattern in pricing, which therefore makes it harder to implement a successful trading strategy.

Preparing for Bitcoin Halving 2024

Previous Halving events led to an upswing in the price of Bitcoin. The first Halving saw BTC’s price jump from $11 to $1,100, the second Halving led to the value of Bitcoin to increase from $600 to $20,000 in 18 months, while the third led to Bitcoin rising from $9,000 to around $30,000. However, the circumstances surrounding each Halving may be different and demand for Bitcoin can fluctuate wildly, particularly in light of the coronavirus pandemic, the war in Ukraine, as well as inflation, all of which have proven to be an economic test for even the most “stable” of assets.

The next Bitcoin halving event is expected to take place in April, 2024 and investors would have to wait and see how this event would affect its price.

How to Trade the Bitcoin Halving?

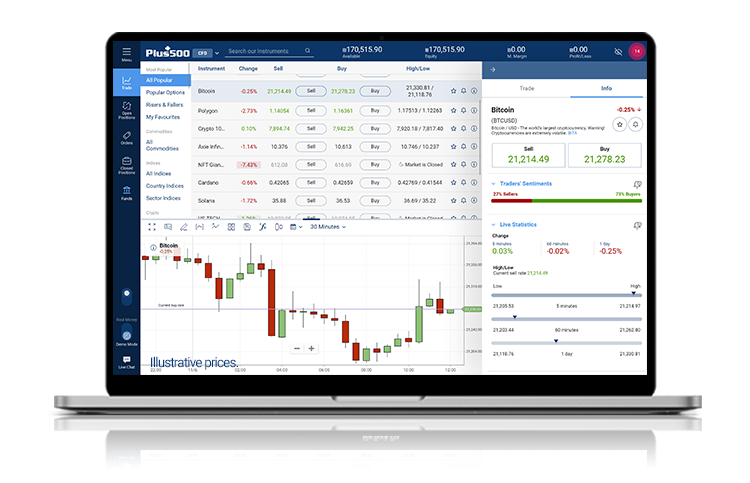

Bitcoin is expensive to buy. If you BUY Bitcoin and the price crashes, you will be stuck with an expensive loss. An alternative to buying Bitcoin would be trading CFDs on Bitcoin, which means you can speculate on the price movement, rather than buying the asset outright. You can also wait for the Halving event to occur and then open either BUY or SELL positions in BTC/USD, depending on which way you believe the pair is moving. Additionally with CFDs, you can trade in both rising or falling markets. If you believe the price of Bitcoin will drop then you can open a SELL position. Alternatively, if you believe the price will be moving up, then you can BUY low and SELL high. Learn more about CFD trading in our “What Is CFD Trading” article and video.

How Do I Manage the Risks of Trading Bitcoin?

There are various measures you can employ to manage your risk while trading Bitcoin, including limiting the capital you put into each trade. That can be 10%, 5% or less depending on your trading strategy.

You can also use risk management tools like the Stop Loss and Take Profit orders that you will find on the Plus500 platform. Stop Loss stops out your trades when the value of the asset falls to, or past, a certain level. Take Profit allows you to close a position when it has accrued a certain level of profit in order to lock in the profits. There is also the Guaranteed Stop order, for which a fee is charged but it guarantees that your position will close at the exact rate you specify.

Illustrative prices.

How Will the Bitcoin Halving Impact the Crypto Markets?

In terms of the crypto market as a whole, Bitcoin tends to be the flag bearer for the wider market. Most of the leading cryptocurrencies seem to rise when Bitcoin rises for a reasonable time, drawing the conclusion that altcoins, like Ethereum and Litecoin, and Bitcoin bull periods may be positively correlated. The aphorism “A rising tide lifts all boats” certainly seems to be the case with the altcoins, which have been trading in a bullish trend after each past Halving. While the global economy is in chaos, and almost all assets are suffering as a result, Bitcoin owners may potentially once again reap the rewards of the next Halving. Watch this space and remember you can trade Bitcoin CFDs with Plus500.

Conclusions and Takeaways

In conclusion, the next Bitcoin Halving which is expected to happen in April 2024 can be a volatility-inducing event that can shift the overall markets, in general, and the Crypto sector, in particular. Nonetheless, the extent of this event’s effects is yet to be seen.

*Subject to operator availability

Bitcoin Halving - Frequently Asked Questions:

When is the next Bitcoin halving event?

The next Bitcoin Halving is expected to take place on April 25, 2024.

When will the last Bitcoin be mined?

It is believed that the last Bitcoin to be mined will be in the year 2140.

What will be the price of BTC after the Bitcoin halving?

While the exact price of Bitcoin is yet to be determined, the expectations are for Bitcoin’s price to hit 6 figures following 2024’s halving.

How many Bitcoin halvings are left?

Overall, a total of 32 Bitcoin Halvings is set to happen, which leaves 29 more Halvings to come.